Gold IRA Guide

A gold IRA is a niche investment item. This specialized IRA may help branch out a profile given that gold and silvers, including gold, are typically taken into consideration a financial investment to pound inflation. However it’s crucial to analysis whether a precious metals IRA account makes good sense as part of your retirement funds and total retirement savings plan.

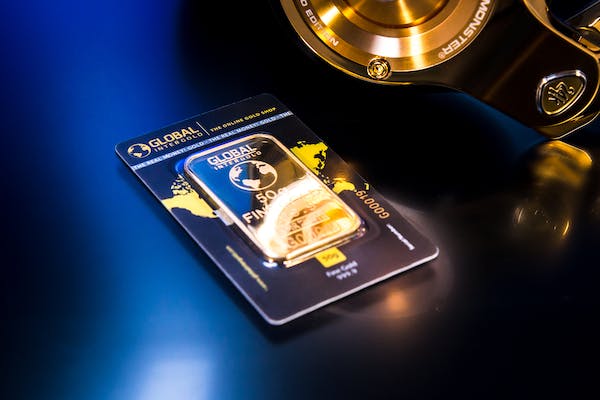

Many gold and silvers IRA business offer IRA-approved silver, platinum eagle and palladium in their IRAs in addition to gold. A gold IRA is actually distinguishing considering that you have the true metals, rather than stocks or portions of funds in exploration firms. Outlook India Gold IRA company

Is actually a 401( k) to gold IRA rollover right for me?

A gold IRA is an item best satisfied for innovative entrepreneurs along with knowledge in precious metals putting in. If you possess inquiries, seek advice from an economic specialist who is actually a fiduciary to decide whether gold makes good sense in the context of your existing retirement accounts. Gold IRA providers are actually certainly not guardians as well as need to not be relied on for monetary assistance.

If, when calculating your investment process, you choose to roll over a 401( k) to a gold IRA– as in, market the whole balance of a traditional account containing stocks, connections and/or stock funds so as to buy gold– you’re making a very big change to your expenditure profile page. Doing this must be actually widely researched beforehand. If you’re unsure, take some time to find out the difference between an IRA vs. 401( k).

A traditional retirement account keeping assets and also connections offers you the possibility to become revealed to an assortment of resources, which gives the complying with advantages:

Create revenue using returns

Develop a varied investment mix to reduce market volatility

Use market assets to change your allocation to your committing goals

Some gold IRA business describe their offerings as “diverse” considering that you may secure much more than one kind of metal in it. From a committing point of view, this is not assorted. Precious metals– also various ones– are part of the very same resource course and also do certainly not generate earnings, unlike dividend-earning resources.

Some gold IRA companies additionally describe assets as well as connects as “paper properties” and signify they are actually a single possession course. This is not the instance. You can easily possess a well-diversified profile along with a mix of stocks as well as connections.

Be sure to consider the costs of cashing out at the same time: When you reach out to the age of 73 as well as has to start taking RMDs from your retirement accounts, you need to possess your gold coins as well as gold bullion delivered to you. That necessitates spending for delivery and insurance coverage, or even liquidating a number of your gold.

A lot of gold IRA providers will certainly buy back gold and silvers you purchased from all of them, however buybacks are actually usually at the retail price, which commonly is around 30% less than prevailing retail gold prices.

Exactly how performs a 401( k) to gold IRA carry over work?

If you’ve decided a gold IRA is right for you, you can easily contact your individual retirement account administrator or even possess the gold IRA company accomplish this. An institution-to-institution move is actually suggested since you certainly never take management of the funds yourself, which saves you the danger of a prospective tax charge.

If you do opt for to deal with that circulation on your own, the IRS has a stringent 60-day home window coming from the date you acquire the funds to roll that loan over in to one more skilled retirement account, or the IRS will definitely alleviate that distribution as a withdrawal as well as management you tax obligations plus a very early drawback charge if you are much younger than 59 1/2 years old.

Why should I surrender my 401( k) right into a gold IRA?

Unanticipated losses coming from acquiring gold can thwart your retirement plan. Rolling over a 401( k) into a gold IRA is not a choice you should make lightly. You must consult with an individual economic advisor to review your investing timetable, objectives and also take the chance of endurance to identify whether a gold IRA financial investment or a silver IRA deserves an area in your retirement life collection.

Remember that you are actually purchasing your IRA gold with pre-tax dollars, so you are actually taxed when you take circulations, as you will be with 401( k) s as well as various other tax-deferred pension. If you need to take demanded minimal distributions (RMDs) and also don’t have the money to spend taxes been obligated to repay at the time you take circulations, you could must sell off a number of your rare-earth elements.

Investing in a gold IRA

The rare-earth elements in a gold IRA are generally pieces as well as pubs approved by the IRS for IRA trading. You may select a mix of gold and silver, and some gold IRA business also permit you include platinum and also palladium to your IRA. When you must start taking demanded minimal distributions, you may select to sell off the gold or have it transported to you. In most cases, you will certainly purchase shipping, thus make sure to factor in that expense.

Most gold IRA business will certainly redeem gold or various other precious metals they sold you, but these buyback systems are actually commonly carried out at the wholesale price, which is about a third less costly than the retail price.

How perform you hold physical gold in an IRA?

Unlike a gold ETF, an exchange-traded fund that tracks the functionality of gold, a gold IRA permits you keep the bodily precious metals, offered you keep them in an IRS-approved vault organization. If you yearn for extra adaptability with your precious metals or intend to maintain all of them in the home, learn more about how to buy gold outside an IRA. If you don’t want the conditions of acquiring bodily gold, you can explore how to get a gold ETF.

Gold IRA cost

Gold IRAs usually demand higher charges than those demanded for other resource courses you may discover in an IRA, like mark funds comprising supplies. If you have a gold IRA, you will certainly incur costs to take care of the account, as well as upkeep expenses, and expenses for safe storing as well as covering your gold Precious metals costs can easily likewise be unstable as time go on and also may not be promised to raise in market value.

IRA-eligible gold.

There are a lot of styles and also types of gold and silvers the IRS has actually approved as IRA-eligible. Certain pieces and clubs produced by the U.S. Mint, the matching organization of particular various other countries, or designated private minting providers, may be composed a gold IRA.

Is actually a gold and silvers IRA the same as a gold IRA?

The phrase “gold IRA” may be actually utilized interchangeably with the key phrase “precious metals IRA.” Although the last is actually practically precise, “gold IRA” is usually made use of as dictation to describe self-reliant IRAs that secure a mix of gold, silver, platinum eagle and/or palladium.

What are actually precious metals?

Metals for functions of IRS-approved gold IRA putting in consist of simply four metallics. The IRS has extremely in-depth requirements that deliver which coins and bars can be kept in a gold IRA. The objective of these exact criteria on size, body weight, style and metal pureness is actually to make certain that retirement savers are actually keeping investment-grade assets, as opposed to valuables, in their profiles.